Administrator-managed prepaid debit card app for elderly & disabled individuals

Timeline: May - August 2022

Role: Research and Design

Background

More and more millennials are taking care of their aging/disabled parents’ finances while also running their own busy life with careers and children. They find it a struggle to balance allowing their loved ones’ independence with spending money while keeping the rest of their money safe from overspending and scammers. How could busy millennials give their parents some sense of independence and dignity with money while still maintaining the security of their loved one’s livelihood without having to commit even more time out of their busy lives?

Hypothesis

An app that allows the caretaker to fund a prepaid debit card - similar to those on the market for teens - in specific amounts and manage the account would give ease of access for the administrator and retain dignity and independence for the parent.

Why?

There is a lack of accessibility to easy-to-manage prepaid debit cards for this segment of people. The vast majority of the administrator-managed prepaid debit cards with mobile app access are structured for a parent/child scenario with chores & allowances built-in which serves to damage the dignity of someone who doesn’t fit this role.

As a millennial who manages my disabled father-in-law’s finances, I scoured the market for the right solution and finally felt forced to settle on a parent/child card solution despite having to explain to him that though it’s designed for a child, we don’t see him as a child.

Business Opportunities

This segment can easily be expanded upon to include more than just elderly and disabled parents.

Spending Problems

Elderly / Disabled

Mental Disabilities

Research

User Interviews

User interviews were conducted with those who met the criteria above with the intention of validating the desire of this segment of individuals and whether they would benefit from this type of app in the marketplace.

Some of the questions asked included:

Their involvement with financial support for an elderly or disabled individual

The level of independence of the person being cared for

Would this person be able to or need to have a debit card of their own for spending money?

What resources do they use to help them find support

What support services they use(d)

The final two questions were asked with the intention of finding resources for potential partnerships or promotion of the app in the future. Additionally, these services were used in research to determine what competitor apps might already exist in this space. There weren’t any targeted to this segment.

Insights

Notes from user interviews were synthesized and compiled (along with my own experience as a potential user) to glean the insights that influenced the design and function of the app.

Cash is the primary method of spending used for this segment

Those who give cash do worry about it getting lost and taking that risk

Keeping an eye on spending is important to the caregivers

Most cardholders in these situations should not have access to funding the cards themselves

Caregivers would use this type of card and would appreciate a mobile app for ease of access

Empathy Mapping

I opted to compile the like characteristics of the users that were surveyed and interviewed, as well as my own experiences, to gain a clearer understanding of the primary tasks and design of the app.

Concept

Miro was my tool of choice to lay out the flows and information architecture for this project. I prioritized the flows that would show what the basic functions of the app would be for a potential MVP. This also gave me the opportunity to identify some additional opportunities for expansion of this app.

Expansion Opportunities

Varying views for transactions

Export options for transaction history

Integration with Plaid or MX Technologies for direct secure connection to bank accounts for funding

Can be used for managing multiple cards in the case of government-assigned caregivers, attorneys, etc.

Sketches and Wireframes

In the interest of testing early and often, I began user testing with low fidelity wireframes on an Adobe XD prototype with the primary tasks needed to create an MVP.

After user testing the prototype, a change was made to the signup flow order to refine the process more.

Design

This app was designed with the user in mind based on the insights learned during user testing with the low-fidelity prototypes - more details on the learnings below. I focused on the primary tasks needed to build the minimum viable product and satisfy our users critical needs.

Create an account

Having the account creation process be handled by the administrator ensures that the cardholder doesn’t gain access to fund the card

Link an account for funding

Being able to add funds to a card requires a connection to some type of bank account. This is a fundamental function of the app and the goal was to keep it quick and easy. Future iterations could be to partner with a service such as Plaid or MX Technologies for a secure direct connection to a bank account.

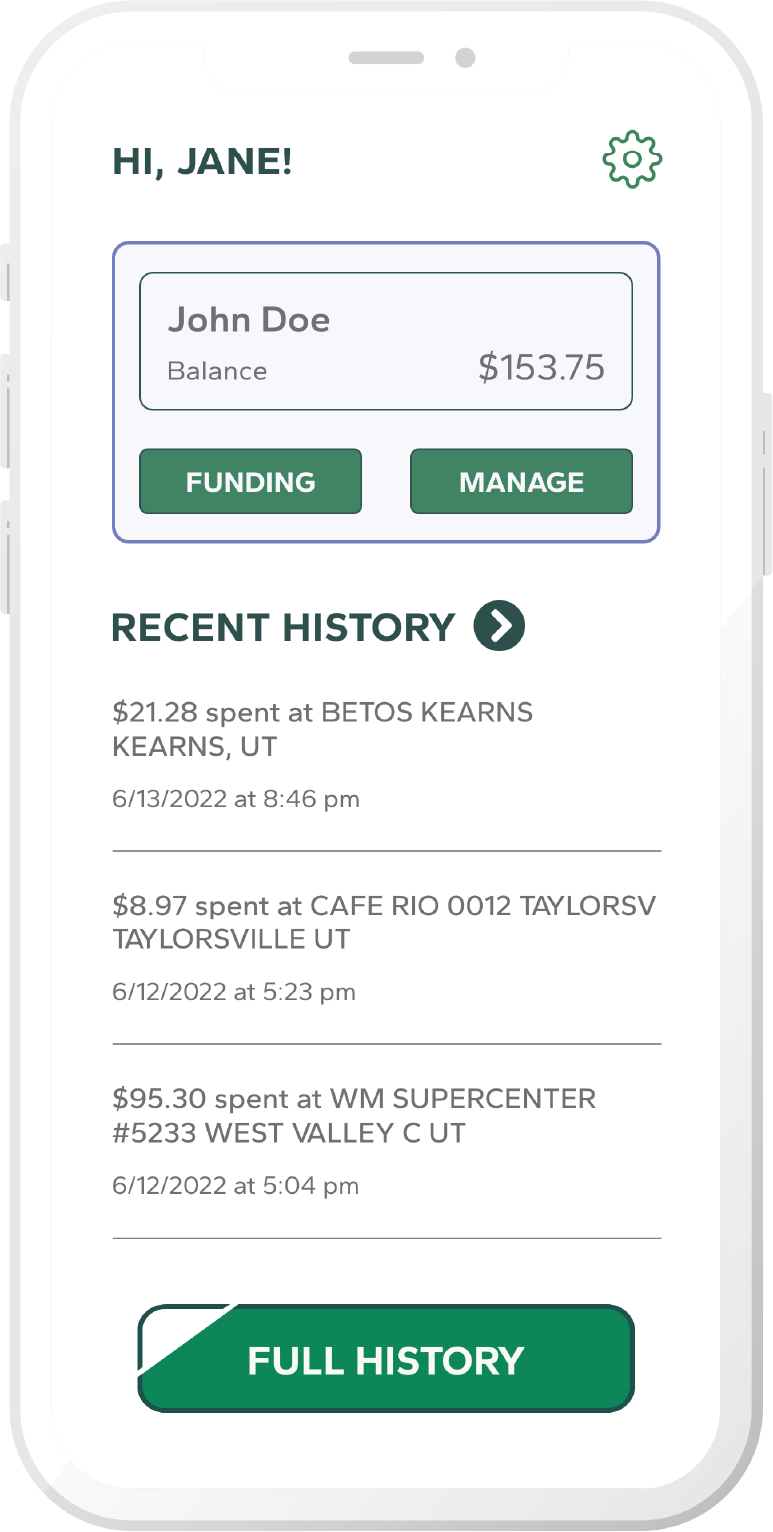

View Transaction History

Quick access to transaction history is provided through a glance on the main dashboard for the most recent three transactions and extensive history is one tap away from the dashboard upon login. Future iterations will add additional transaction sorting, viewing, and exporting options.

Fund a card with a one-time transfer

The process of funding a card should be quick and easy for the administrator. This flow was designed to be as few steps as possible from the dashboard to let the administrator get back to their busy life.

Fund a card with a recurring transfer

Recurring transfers allow the administrator to “set it and forget it”. It gives the administrator peace of mind and the cardholder predictability. Because the cardholder doesn’t have access to fund their own card, they know when they can expect it to be reloaded.

Visual System

OutComes

Deliverables

Designed and prototyped screens demonstrating a prepaid debit card app that would serve a non-child/teenager demographic.

Values

Having empathy for a different demographic was the biggest motivator for creating this app. The concept of a teen-focused prepaid debit card app is applicable to an underserved, yet proven, demographic, but it’s demeaning with parent/child language and being chores & allowance focused.

This app could empower elderly and/or disabled individuals to have independence with their spending without treating them like children.